Basic description

Capital Adequacy Ratio is the ratio of a credit union’s capital to its risk. National regulators track the Capital Adequacy Ratio to ensure that it can absorb a reasonable amount of loss and that it complies with statutory Capital requirements.

Uses

To measure a credit union’s available capital expressed as a percentage of the credit unions risk-weighted credit exposure. The Capital Adequacy Ratio, also known as capital-to-risk weighted assets ratio is used to protect depositors and promote the stability and efficiency of financial systems around the world.

The following Ratios are used:-

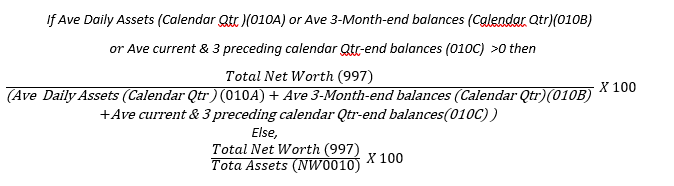

• Net Worth Ratio

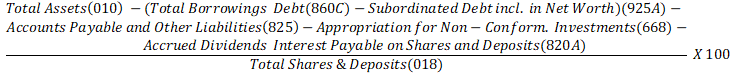

• Solvency Evaluation (Estimation)

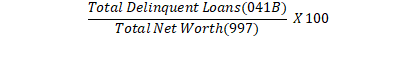

• Total Delinquent Loan/Net Worth

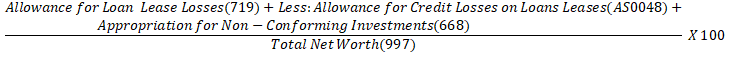

• Classified Assets(Est.) / Net Worth

Options

You can select:-

- Quarter end Date

- State

- Credit Union

- Peer Group

- Regions

- Asset Ranges

- All Credit Unions - Trend Line - Options are 1, 2 and 3 Year Trends

Comments

0 comments

Please sign in to leave a comment.