Basic description

This report presents four charts showing performance and or comparative results against Credit Unions/Peer Groups for various reporting quarters, and recent trends.

Uses

This report is the landing page for Peer Analysis and is designed to show the current snapshot, and recent trends, of the lending business against its Peers and the Industry’s Target ratio at a glance.

Sustainability

This graph measures the credit unions growth and sustainability.

The regulator sets the capital ratio as a standard; (Net worth, divided by Assets). Net Worth Growth (RoE) must be equal to or greater than asset growth to maintain or improve the Net worth Ratio over the long term.

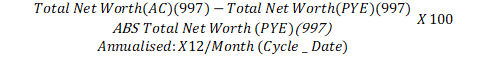

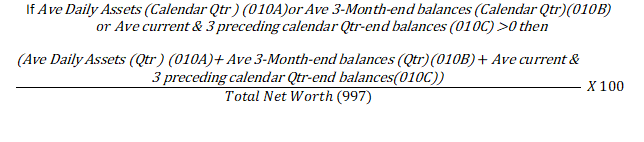

- Measures the RoE (Net Worth Growth), formula as below

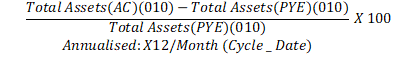

- Measures the Asset Growth, formula as below

- US GDP

Gross Domestic Growth plus Inflation

Return on Assets

This graph shows the comparison between your Return on Asset ratio, and the Peer Group value

Uses Information from Credit Union, Peer Group

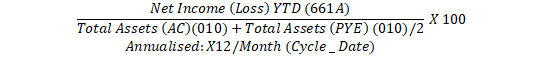

The ratio

Net Worth Growth

This graph shows the comparison between your Net worth Ratio, the Peer Group value as well as the Target set by the industry.

Uses information from Credit union, Peer Group, Target Capital Ratio

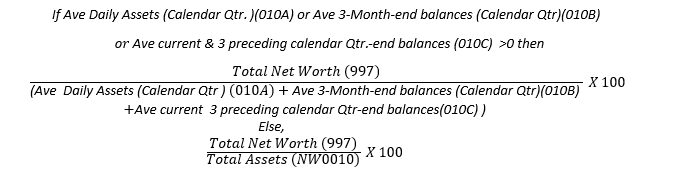

The Ratio

Leverage (Assets / Net Worth)

This graph shows the leverage of Assets divided by Net Worth, it shows the comparison between your credit union and the Peer Group.

Uses information from Credit Union, Peer Group

The Ratio

BankBI Ratio

Options

You can select:-

• Quarter end Dates

• States

• Credit Unions

• Peer Groups

- Regions

- Asset Ranges

- All Credit Unions

• Trend Line - Options are 1, 2 and 3 Year Trends

Comments

0 comments

Please sign in to leave a comment.